When evaluating companies, PineBridge’s due diligence approach can be divided into three major buckets: governance and leadership, business sustainability, and financial strength. ‘It’s about understanding the nuts and bolts – competitive advantage, industry structure, management and, of course, ESG,’ Hinchliffe said. ‘We use a forward-looking perspective, and ESG metrics are ingrained into that. All of these factors help us to assess a very specific alpha source we are targeting: the positive, gradual change in companies over time.’

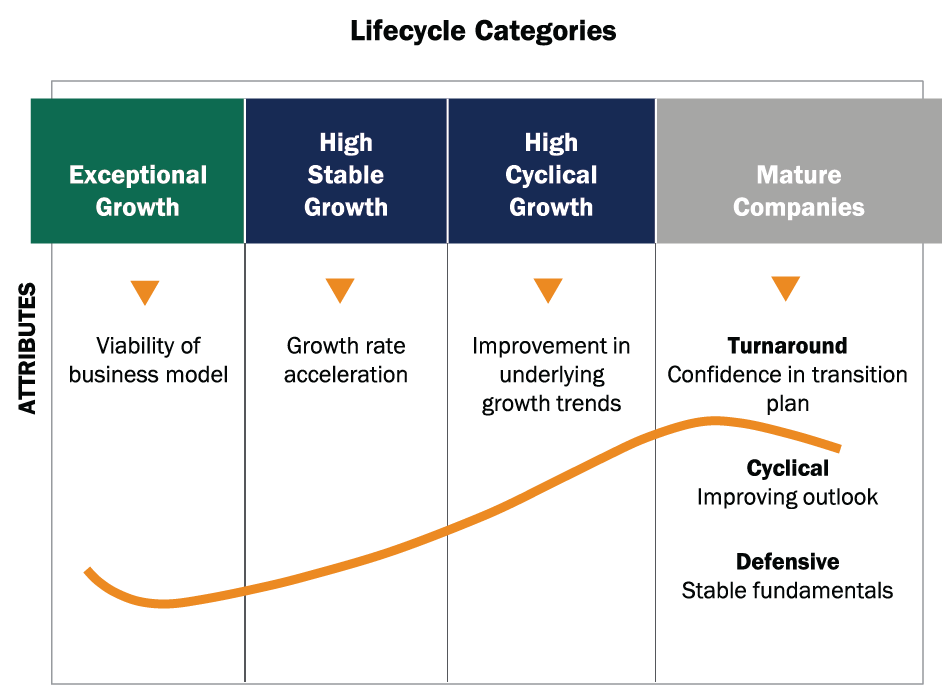

LCR is a key differentiator of PineBridge’s approach to equity selection, ‘Most investors manage portfolios based on MSCI sectors. We don’t do that, Hinchcliffe added. We have our own segmentation approach that divides the entire market into six homogeneous groups – or life cycle categories. These essentially follow the life cycle curve of any company, from early stage to very mature.’

Seeing the patterns

The point of establishing these homogeneous groups, based on a company’s growth stage relative to its stability, is that irrespective of sector, companies within a particular grouping behave very similarly in the market. ‘In a way, the six life cycle groupings are style factors. This enables us to be very precise about our risk controls,’ Hinchcliffe said.

‘LCR means we have a very good sense of the different exposures within the benchmark,’ Hinchliffe explained. ‘When we construct the portfolio, this means we can do it by taking the risks we want. For example, if we have uncovered opportunities to invest in companies that will benefit from a particular long-term trend, say supply-chain near-shoring, we can do that. But at the same time, we want to minimise other risks. So we construct the portfolio to be neutral to, say, commodity prices.’

Using Global Industry Classification Standard (GICS) sector categorisations is an imperfect way of managing risk. ‘If you take consumer discretionary, you have companies like Amazon, Tesla and GM all within that category. And if we look at just the two auto-makers – Tesla and GM – they have totally different drivers’.